Choosing a bank card for travel

The choice of bank cards is so large that it is sometimes impossible to decide on it. However, many bank cards have a specific purpose, or rather, they bring benefits to their holder depending on their needs, for example, some of them allow you to receive interest on the balance or cashback, others give privileges from their purchases when paying for goods and services or air and railway tickets. In particular, banks offer plastic to customers who will use them while traveling. Therefore, consider what is the best credit card for travel, and its conditions.

How to choose the right travel offer

First of all, it should be noted that the choice of a bank card for travel should depend on several factors. To begin with, you must decide what type of plastic you would like to receive credit or debit, that is, you intend to keep your own funds in an account or use borrowed funds. The fact is that some banks offer interest on the balance for debit card holders, which makes the use of plastic more profitable, because the client receives income from his own savings.

The second selection criterion is the payment system. If you are going abroad, you must choose a card that can be used to pay outside our country, some cards, in particular, World Maestro, Visa Electron, are not intended for these purposes, so their issuance for trips is impractical.

In addition, if you are going to travel to Europe, then it is wiser for you to get a MasterCard card to avoid double currency conversion. Because payments in Europe are made in euros, and the main currency of the Mastercard card is also euros. Therefore, when paying for goods and services, one currency conversion from rubles to euros takes place. If you issue a Visa, then the conversion will be carried out as follows: first, rubles are converted into dollars, and then into euros. It follows that the user will have to pay a high commission. But if you are going to rest in countries where dollars are accepted for payment, then the Visa payment system would be an ideal option for you.

Please note that some commercial banks offer users cards in foreign currencies, such as dollars or euros, if such an opportunity exists, then you should definitely use it when traveling abroad.

So, there are still a few more nuances that you should pay attention to when applying for a card, in particular, the cost of annual maintenance. Classic cards will cost the user from 500 to 1000 rubles a year, platinum and gold from 2000 rubles or more. If you want to get a credit card, pay attention to the annual percentage and grace period, which allows you to save on interest.

The best maps for travelers

There are about 500 commercial banks in our country, each of which offer plastic cards for their customers, in particular, banks today, in order to attract customers, issue specialized products for travelers that allow not only using a payment instrument, but also receiving additional opportunities in the form of cashback, privileged service abroad and free insurance. Here are the TOP 5 plastic cards for paying for goods and services abroad.

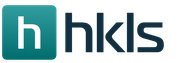

Discovery Travel

The truly best travel debit cards are offered by Otkritie Bank, and here you can find several options, depending on your preferences and budget. Otkritie Bank offers its customers the Otkritie Travel debit card, which is issued as part of three service packages: Premium, Optimal and Basic. It is on its type that the cost of annual maintenance and other privileged conditions for customers depend. Consider the cost of annual maintenance:

- Basic package 99 rubles per month or free of charge with a balance of 50,000 rubles.

- Package Optimal 299 rubles per month or free of charge with an account balance of 150,000 rubles.

- Premium package 2500 rubles per month, with an account balance of more than 600 thousand rubles free of charge.

If we talk about the benefits for travelers, then the full range of services is provided by the Premium package. After all, it is he who offers a free transfer to and from the airport, as well as access to airport business lounges under the Priority Pass program, at the same time, the user can use the service package for free if he keeps at least 600,000 rubles on his account and pays for purchases in the amount of 50,000 rubles. Among other things, the bank charges interest on the balance of 6.5% under the My Piggy Bank program.

But these are not the main advantages of the banking product, because it makes it possible to pay for goods and services and at the same time receives bonuses within the Premium package, the bonus is 4 rubles from every 100 rubles. In the optimal package, 5 rubles are charged for every 100 rubles. In the basic package - 5 rubles for every 100 rubles spent. But the program is distributed only when paying for air or railway tickets, as well as hotels on the website https://travel.open.ru.

Please note that under the terms of this card, the user can withdraw cash from any ATM without commission.

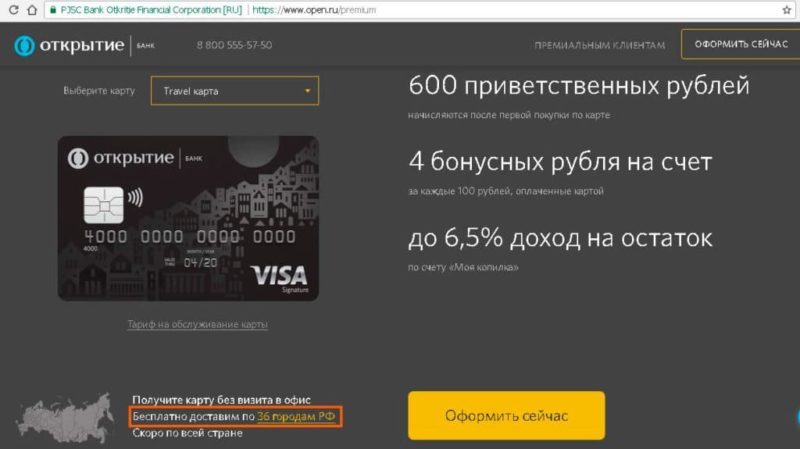

VTB 24 Multicard

The VTB24 bank multicard combines several advantages for the user at once. First of all, it can be issued both credit and debit, it makes it possible to receive up to 10% cashback when paying for fuel at gas stations, parking lots, as well as restaurants and cafes, up to 2% cashback on any purchases with a card, plus miles or bonuses for all purchases up to 4%. The interest on the balance is up to 10% on a debit card, on a credit card it can also receive interest on the balance, provided that you keep your own savings on it.

With regard to individual terms of service, the bank does not charge a fee for annual service. For a credit card, the grace period is up to 50 days, the credit limit is up to 1 million rubles, the annual interest on the loan is 26% per year. By the way, the owner of plastic can receive cash in self-service devices without commission fees.

Sberbank card - Aeroflot

The bank offers Aeroflot credit and debit cards in different versions, from classic to premium. If we talk about the benefits for travelers, then it allows you to earn miles from your purchases and spend them on tickets with Aeroflot airlines. If you're looking for the best travel card, the Visa Signature credit card is a smart option here, and there are several reasons for this, as it gives you these additional features:

- free unlimited internet in roaming for Beeline and MTS subscribers;

- 35% discount on car rental with Avis;

- a 12% discount on hotel stays with Agoda;

- 20% discount on transfers to and from the airport with Gett and Wheely;

- free baggage packing with PACK

- compensation in the amount of 600 euros in case of a flight delay or cancellation with Compensair.

But that's not all the opportunities and benefits, because plastic owners can receive free medical and legal advice, enjoy all the privileges of the Visa system, use the concierge service and receive cash on an emergency basis in case of loss of the card. However, it has one significant drawback - this is the high cost of annual maintenance - 12,000 rubles a year.

Important! That the Visa Signature card gives its owner the opportunity to use VIP lounges at airports as part of the Priority Pass service, however, for a fee.

ALL Airlines from Tinkoff Bank

The Tinkoff ALL Airlines card is one of the best offers for travelers, because the bank provides many opportunities. First of all, it is worth noting that the card is issued by the MasterCard payment system, which means it will be ideal for traveling around Europe. The user has the opportunity to purchase air tickets of any Russian airlines at the expense of miles. One mile is equal to one ruble, it is very easy to accumulate miles, because the bank returns from 2 to 30% of purchases to the cardholder's bonus account.

As for the terms of service for the plastic itself, there is a grace period of up to 55 days, the cost of annual maintenance is 1890 rubles per year, the credit limit and the annual percentage are determined individually for each borrower. And the most important advantage is that when issuing this card, its owner receives free insurance for traveling around the world.

Similarly, at Tinkoff Bank, a user can issue an ALL Airlines debit card. It has no credit limit, which means that the bank offers additional bonuses for the user, in particular, interest on the balance in the form of 6% per annum, expressed in miles on the account balance. Another advantage of this product is that the user can withdraw cash worldwide without commission.

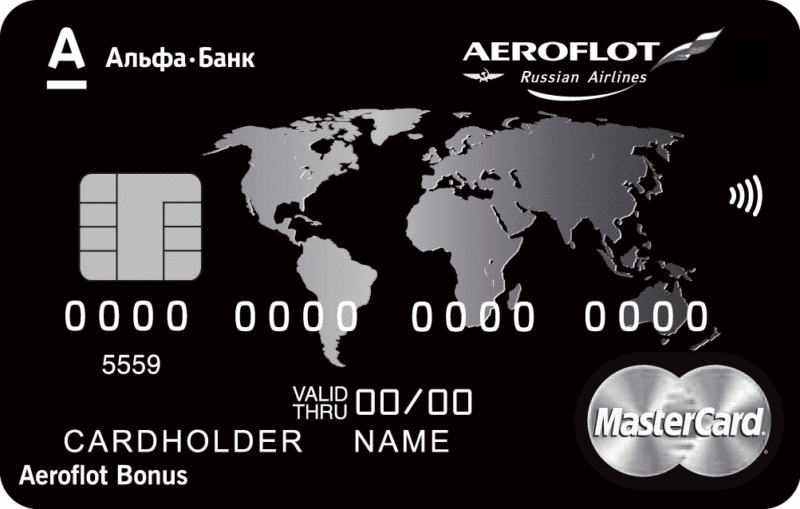

Alfa Bank

It offers several credit cards to customers, which also allow them to accumulate bonuses and exchange them for air travel. At the moment, there are four credit cards - Aeroflot Standard, Gold, Platinum, World Black Edition. Under the Standard program, the user receives 1.1 miles for every 60 rubles spent on the card + 500 miles as a gift, the credit limit on the card is 300,000 rubles, the cost of annual maintenance is 990 rubles.

The Gold plastic card allows you to save 1.5 miles for every 60 rubles from purchases, and pay for air tickets, hotels, rent, cars at their expense. When making plastic, the client receives a thousand miles as a gift, a credit limit of up to 500,000 rubles, an annual service of 2,490 rubles, an interest rate of 23.9%, a grace period of 60 days.

On a platinum card, the bank accrues a bonus of 1.75 miles for every 60 rubles. They can be used to pay for air tickets, hotels, car rentals, and you can also exchange air tickets in economy class for business class for miles. Credit limit up to 1 million rubles, annual service cost 7990 rubles, interest-free period 60 days, annual rate from 23.99%.

Plastic under the Aeroflot World Black Edition brand allows you to receive two bonus miles for every 60 rubles, the bank gives 1,000 welcome miles when you receive plastic, a credit limit of up to one million rubles, a 60-day grace period that applies to cash withdrawals, the rate is from 23 99% per year, the cost of annual maintenance is 11990 rubles. In addition, cardholders receive free travel insurance.

Conclusion

These are not all the best cards for travelers, in fact, there are a lot of them on the financial services market. As you can see, all of them differ significantly from each other, but each user needs to first of all pay attention to the level of plastic, because classic cards practically do not give any privileges, only minimal cashback and the opportunity to accumulate miles, their service cost is the lowest.

Higher-level Gold and Platinum cards provide enhanced opportunities to their customers, among other things, the owners of such cards can enjoy other privileges in the bank, including a dedicated telephone line and other features. True, the user will have to pay a high price for the service. If you pay attention, the service fee has almost no limit.

So, to summarize, travelers can indeed receive certain privileges from commercial banks, however, for a fee, and the higher the cost of the card, the more opportunities it provides to its owner. But from the foregoing, we can still conclude that with a card you can really save on paying for air tickets, hotels and car rentals. Among other things, the bank charges interest on purchases, which makes using the card more profitable than cash.