All about take profit and why you should use it

Many traders, when trading on the Forex market, do not always use take profit, preferring to close positions manually or wait until the market closes them on its own - a stop out will be triggered.

To be on the safe side and make a profit even in force majeure circumstances, there is a take profit.

However, take profit is quite a useful tool, especially if a trader, for some reason, does not have the ability to constantly monitor an open deal. In this case, take profit becomes very useful.

How take profit works

Imagine a situation: a trader predicts a rise in the price of the GBP / USD pair. The forecast came true, the price goes up, the trader is waiting for a certain level of profit. But a routine situation arises, the trader is distracted by something: the Internet is gone, a computer breakdown occurs, or the power supply is turned off, anything can happen. At the same time, the trader does not have the opportunity to personally follow the process. The price increased by a couple more points, bounced off the resistance level and headed down.

An important circumstance - the take-profit deal will be closed even when the trading terminal is turned off.

When a trader does get a chance to check his open trade, he discovers that the price has reversed and the order was closed with a loss. This situation is possible at any time.

To be on the safe side and make a profit even in force majeure circumstances, there is a take profit.

What is take profit

Take profit is a financial instrument that allows you to take profit. By applying take profit, the trader always knows that the trade will close automatically as soon as the price reaches the desired value. For example, it is not always possible, even while sitting and carefully monitoring the price movement, to exit a trade. This situation can happen to the market at the time of the release of important news.

Another important circumstance is that the take-profit deal will be closed even when the trading terminal is turned off.

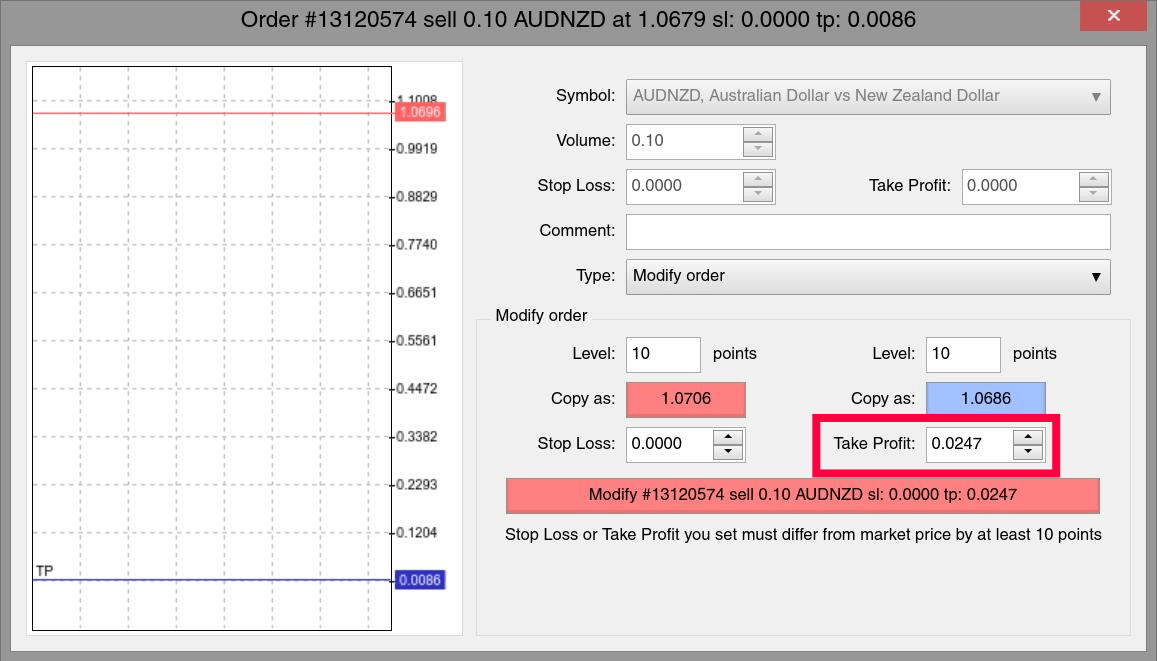

Take profit is set in the following way. The MT4 terminal has a New Order tab on the toolbar. In the window that appears, select the take profit value. The value is set based on the trader's forecasts and, upon reaching the set price, the deal will be closed in profit.

If for some reason a trader forgot to place a take profit or wants to change its parameters, then in the bottom MT4 panel, double-click on the line with an open deal.

Do not forget about one feature. Depending on the type of trade, buy or sell, the take profit setting mechanism is different.

- When buying, take profit is set above the price.

- On sale - below.

You can't make a mistake. If the price is set incorrectly, MetaTrader will display an error.

Determining the size of the take profit

There are many options to choose from. Basically, one should start from the nature of the market, the current situation on it and the applied trading tactics.

The three most commonly used methods are:

Local highs or lows at which price reversals occurred. The method is considered to be the simplest and has proven itself excellently. When the price rises, the price rarely immediately surpasses the maximum; it is usually the price reversal and its reverse movement. Therefore, when buying, you should set take profit near the maximum. When selling, you need to pay attention to the minimum, placing take profit within it. Using this method, it is reasonable to decrease or increase the size of the take profit by 5-10 points, depending on the situation.

Fibonacci levels. In this case, the retracement levels from the previous movement serve as a reference point, which act as a kind of resistance or support lines.

Based on the expected loss level. Profit should always exceed possible losses by at least 1.5 times, and better by two or three. Following this calculation, the take profit should be greater than the stop loss value.

In addition to the methods considered, there are others. There are a great many traders in the world and each one brings something new, sometimes even useful.

- Trailing stop... The price moves in the direction you want, the stop loss changes after it. Convenient for those who are not able to track changes in quotes for a long time. Having opened a trade, a trader can turn on a trailing stop, indicate at what distance from the price to move, and go about his business. After a while, the deal will close itself. The downside is that a fixed take profit is often more profitable.

- Fibonacci time zones... Mostly used by lovers of long-term forecasts, who tend to make a minimum of transactions and keep them open for a long time.

- Graphic shapes, they are also often called patterns or patterns. Distinguish between reversal patterns (head and shoulders, double top, double bottom) and continuation (triangle, flag, rising wedge).

In each specific case, the place of placing the take profit is unambiguously stipulated and depends only on the size of the pattern.

I would like to draw special attention to one important circumstance. At the moment the price approaches the take profit, the trader should not change and move it to get more profit. When setting a take-profit level, many use certain factors that indicate exactly this level.

Continuous use of take profit disciplines. It is difficult to test a strategy if the trader is taking risks all the time. The value of the take profit should be verified and under no pretext should be changed after opening a deal, otherwise the trader risks his own funds.