What currency pairs are best for beginners to trade?

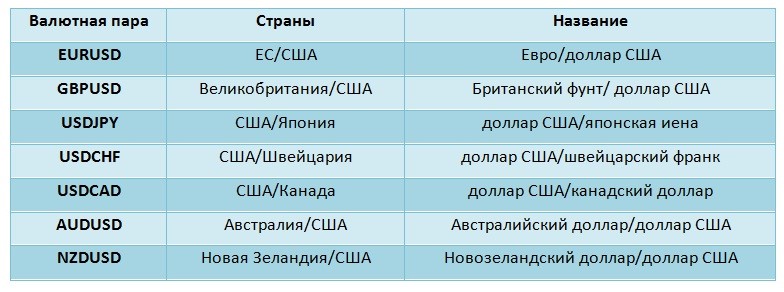

Almost all major brokers offer a trader a wide range of financial instruments, and most novice traders have a question: which currency pair is better for a beginner to trade? The question is far from being idle, since the risks of trading on different instruments can vary significantly. Traditionally, it is considered that the main currency pairs for beginners are the best option. There are not many of them, the list is given in the table below. The main distinguishing feature of these pairs is the participation of the US dollar in their formation.

major currency pairs in forex

As you can see, there are not so many of them either, and the trader must make his choice. Let's look at the selection algorithm and the main characteristics of a trading instrument that must be taken into account in the selection process.

- Understanding the “main driving forces” underlying the currency pair (the state of the economies of the currencies represented in the pair, the main factors in the movement of each of the currencies of the pair, which economic indicators, political events and news it significantly reacts to);

- Predictability of quotes dynamics by means of technical analysis (how significant levels, patterns are worked out);

- The time of maximum and minimum activity of the currency pair;

- Volatility (the lower the volatility, the lower the level of risk); Below is the average volatility of some currency pairs in different trading sessions:

- Liquidity (the less liquidity, the greater the risk).

The most liquid, in descending order, are the US dollar, Euro, British pound sterling, Swiss franc, Japanese yen, Canadian dollar, Australian dollar. Their high liquidity is due to their widespread use in international settlements for goods and services supplied, the formation of NB reserves, as a means of payment in mutual settlements for oil and products of its processing; Pairs with more liquidity trade with less slippage and relatively fast order execution;

- Spread type and size (usually, the higher the liquidity, the lower the spread);

In order to better understand which currency pairs it is better to trade on, a beginner needs to familiarize himself with a brief description of some of the main currency pairs.

characteristics of currency pairs

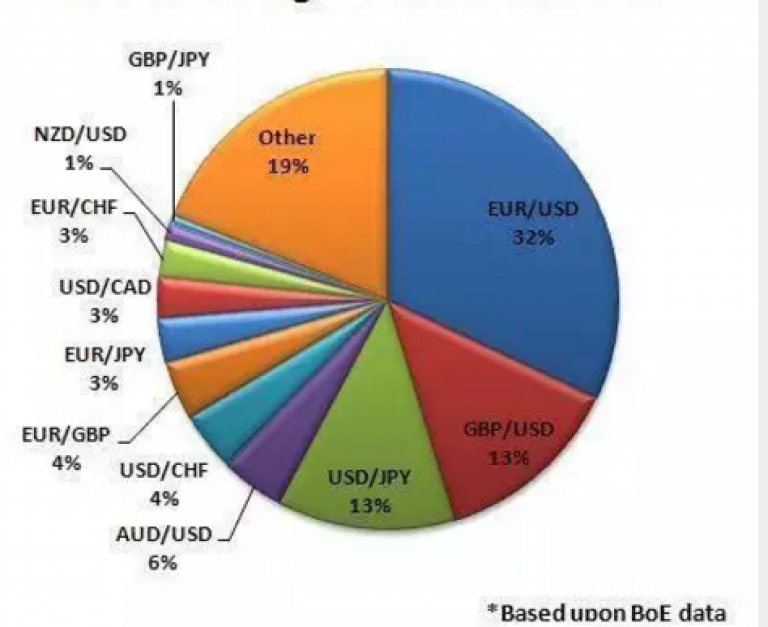

EURUSD is one of the most liquid pairs; according to various sources, it accounts for from 22 to 32%. A lot of analytical materials and forecasts from leading experts and analytical agencies are published for this pair. The average daily volatility is about 100 points, the dynamics of movement is well predicted by technical tools. Most of the trend movements fall on the London and American trading sessions. Strongly reacts to the release of economic indicators NFP, FOMC, political events. Directly correlated with GBP/USD and gold, inversely correlated with USD/CHF. This pair is quite suitable for beginners.

GBP/USD is the third financial instrument in terms of liquidity (12-16% of the Forex market). It is characterized by the instability of quotes and high volatility. Quotes are sensitive to fundamental data - the actions of the Bank of England, statistics on the state of the British economy and US macroeconomic data. Maximum liquidity (100-120 points) in the European/American sessions (respectively 10:00 -18:00 and 17:00 -01:00). Correlates with the EUR/USD pair, but in the short term, the correlation is often broken due to the strong volatility of the GBP/USD. Inversely correlates with USD/CHF. It refers to technical instruments, but often generates false signals (false breakdowns of levels), which indicates the weak predictability of this pair's quotes. Not recommended for trading for beginners. This tool is convenient for professional traders using short-term speculative strategies, as well as a medium-term investment tool.

USD/CHF is one of the most highly liquid instruments, although the volatility of this instrument varies at the level of 45-60 points. The course of this pair is predicted relatively easily and with a high level of confidence. Smooth movements are characteristic, sharp price jumps are practically absent, which is important for novice traders; The dynamics of the pair quotes mainly depends on the US dollar quotes, which greatly simplifies the technical/fundamental analysis of the pair. USD/CHF mirrors the dynamics of EUR/USD. The low volatility of USD/CHF makes this instrument uninteresting for trading on short-term time frames. Acceptable for those beginners who are not psychologically ready to accept a high level of risk or an investor with a conservative work strategy.

USD/CAD is a "commodity" currency pair. The dynamics of quotations is mainly determined by oil prices, US statistics, force majeure events. Highly volatile (average 85-90 points). Dynamics with frequent sharp impulsive movements and false breakouts of levels. Data on the US economy, the amount of oil imported into the country greatly affect its movement. Therefore, a trader needs to constantly monitor the business activity index, oil reserves, sales of residential buildings, GDP dynamics. Not suitable for beginners. For those who want to trade it, we advise you to work exclusively on short-term timeframes with a minimum leverage and small volumes, with Stop-loss orders placed at a close distance. The best time to trade is the American session.

AUD / USD - also belongs to the group of highly volatile "commodity" currencies (volatility of about 100 points). At the same time, spreads for this instrument are much higher (at the level of 6-8 points). The pair has a strong correlation with the gold chart. The main trend movements fall on the Australian and Asian sessions. AUD/USD is technically representative. It is extremely important to keep track of data on Australian agricultural exports and information on China, since China is Australia's most important trading partner. The pair is suitable for beginner traders who trade short-term and medium-term time frames.

Thus, given this information, the question of which currency pair is better for a beginner to trade in principle should be clear. Choose the tool that suits you and carefully study its specifics. Experienced traders with a long time of working on the instrument even begin to "intuitively feel" it, and you, with a certain diligence, will also develop such a "flair".

Trade with us -

Do you want to learn how to trade on the stock exchange? Professional training in trading.