How to play on the stock exchange on the Internet - tips for beginner traders + step-by-step instructions on how to start playing on the stock exchange for beginners

Good day, dear readers! Alexey Morozov and Dmitry Shaposhnikov are with you to HeatherBeber. Today we are going to talk about the stock market game - a risky, stressful, but very profitable job.

From the article you will learn:

- How to start playing on the stock exchange on the Internet?

- How can a beginner learn to play correctly on the stock exchange and win?

- What trading tools are suitable for novice traders?

Let's get started!

Content

- Features of the game on the stock exchange via the Internet

- How to learn to play on the stock exchange - an overview of the TOP-3 trading tools

- Tool 1. Stocks

- Tool 2. Futures

- Tool 3. Currency

- Where to start playing on the stock exchange - choosing a suitable strategy

- Option 1. Following the trend

- Example

- Option 3. Patterns

- Option 1. Following the trend

- 5 simple steps how to play on the stock exchange - instruction for dummies

- Step 1. Choosing a broker

- Step 3. Opening a personal account

- Step 5. Start trading

- How to play and win - useful tips for novice traders

- Tip 1. Set the correct position size

- Tip 2. Focus on exiting trades

- Tip 3. Be aware of what's going on in the market

- Tip 4. Always track your results

- Tip 5. Write your plans down on paper

- Conclusion

1. Features of the game on the stock exchange via the Internet

Previously, stock players would gather in huge buildings and trade together. Now the need for this has disappeared - you can sit at home in front of a monitor screen and calmly engage in trading.

Online trading in the stock market, Forex or the commodity exchange allows you to use the latest analytics and keep abreast of any economic news. This is a definite advantage for both beginners and pros.

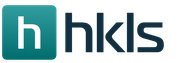

In addition, multifunctional tools are available only in the process of making transactions through the network. Price changes are highlighted on the charts, you can connect any graphical instruments or indicators.

In the Forex for Beginners article, we analyzed the MetaTrader4 trading platform - the best option for trading on the Internet. There are all existing tools, indicators and other usefulness here.

However, it is worth remembering that trading through the network deprives us of the opportunity to see the most accurate currency quotes. Unscrupulous brokers can deceive clients by showing an unreal market situation on a chart.

Therefore, you should not cooperate with services with a dubious reputation, so as not to cry later about the lost money.

2. How to learn to play on the stock exchange - an overview of the TOP-3 trading tools

You can trade on the financial market with a variety of instruments, which we will pay attention to in the article "What is Forex - the Forex market". Below we list three of the simplest and most popular options.

Tool 1. Stocks

Shares are traded on the stock exchange, transactions are opened both offline (traders gather in the buildings of the London, Moscow, Tokyo and other exchanges) and via the Internet.

There is a group of stocks (usually issued by newly emerging companies) that are only worth a few dollars. Naturally, in order to purchase them, a very small deposit is enough.

Shares are securities, the purchase of which means the investor contributes money to the total capital of the company. Stocks can generate income in the form of dividends, they can be sold and earned on rate changes.

However, most of the securities are very expensive. For example, the stock price of Facebook at the time of this writing is $ 130, Berkshire Hathaway - of Warren Buffett's company - $ 145, and so on.

You cannot trade stocks without knowing about the specific features of this instrument. For example, after paying dividends, a share may lose 10-30% of its value.

Tool 2. Futures

Futures are also classified as securities and are traded in the same market segment as stocks.

Futures - a security, according to the terms of which one party undertakes to transfer to the other any commodity after a certain period of time at a fixed price.

For example, an oil producing company issued a futures contract to an enterprise that buys oil, according to its terms, in six months the buyer will receive some volume of black gold at an agreed price.

If, after the agreed period, the price of oil rises, the buyer will be able to sell the raw material at an increased rate and earn money. If the price falls, the sale of purchased products will be unprofitable.

Expiry date - the point in time at which the futures are redeemed.

When we buy futures, this does not mean that someone will supply us with oil, because on the day of expiration our security will be “extinguished” on the exchange, we will either earn or lose money.

Tool 3. Currency

We trade currency pairs on the Forex market, which is not localized anywhere and is traded on the “interbank market”. It is not at all necessary to have huge capitals to carry out transactions with currency, $ 100-200 will be enough to start.

Currency trading also has a lot of its own characteristics. For example, Forex works five days a week (Saturday and Sunday are days off), around the clock. There are many strategies for different time frames.

If in the securities or commodity market, instruments need to be bought for real money, then in Forex we trade using leverage. It allows you to open large transactions with a small deposit.

3. Where to start playing on the stock exchange - choose a suitable strategy

There are a lot of trading strategies on the stock exchange, we have identified five main ones that can be successfully applied in any market - both when trading currencies and when speculating in goods, indices, stocks and others.

Option 1. Following the trend

The trend demonstrates the expectations of the crowd - the mass of traders playing on the stock exchange. Following a trend like a pilot fish following a shark is the smartest trading option.

Example

The logic of following the trend can be easily explained with an example. Let's imagine that we are at a train station where there are a lot of people. Suddenly, panic starts and the crowd rushes in some direction.

If we try to go against her, she will sweep us away and will not notice it; it is much wiser to move in the same way as the bulk of the people.

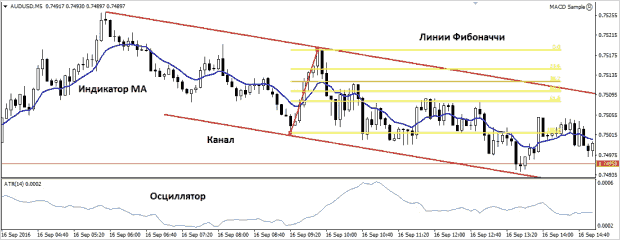

An example of following a trend is trading in an equidistant channel. As soon as the price breaks through the previous top, we open a trade. The goal is to reach the upper boundary of the channel. To determine it, we draw a straight line along the broken candle:

We open a position only when the candlestick that has broken through the level closes. If you open earlier - the candlestick may go down, leaving only a shadow, the signal will turn out to be false.

Example

Trading in the equidistant channel, we made a profit of 20% from $ 1000 of starting capital, so the technique really works.

You can search for profitable deals yourself, or you can read the Analytics published on the websites of the largest brokerage firms.

Option 2. Investment strategy

Almost every broker (we wrote about the most popular companies in Forex Brokers) offers a PAMM account service - you can choose an object for investing money, invest and make a profit.

The profitability can be very different, in our opinion, it is not worth investing under promises of more than 30% of income per month, because the higher the profit, the greater the risk.

Sometimes an investment strategy means opening deals based on fundamental analysis - we enter the market by studying the financial situation and focusing on long-term trading (several weeks or months, sometimes years).

To understand the essence of fundamental analysis, watch the video:

This is not a job for beginners, as it is not an easy task to form a complete picture of the market.

Option 3. Patterns

Patterns are a great opportunity for beginners to make money. They are very easy to find; no serious experience is required to correctly set Stop Loss and Take Profit.

Pattern is a figure formed by a price chart that indicates an impending reversal or trend continuation.

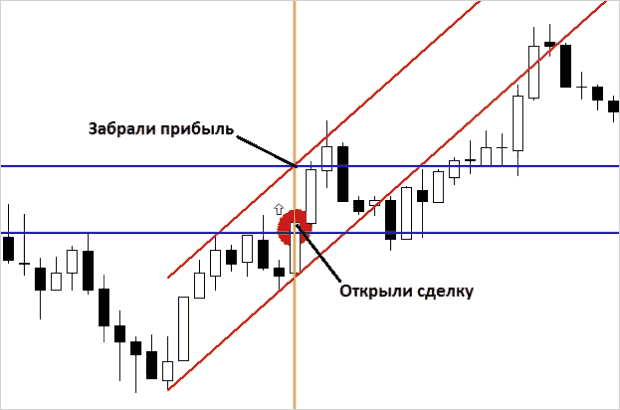

There are many patterns, we will consider two of the most popular. The first is the Head and Shoulders. It will look like this:

The price reaches a high, and then the trend reverses direction, forming two shoulders and a horizontal neckline. All you need to do is measure the distance from head to neck and put it down, defining the Take Profit point.

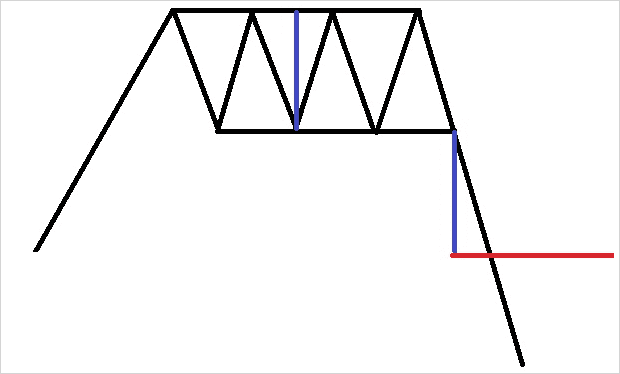

Another interesting pattern is the rectangle. We will present it schematically:

The price moved in a certain direction, then entered the corridor. When the channel is broken through, we enter a trade. Having measured the distance between support and resistance, we postpone it from the support and get the Take Profit line.

Features of trading patterns:

| № | Tools | Characteristic |

| 1 | Timeframes | We trade on large time intervals - at least an hour (H1) |

| 2 | Opening a deal | Not earlier than the closing of the candlestick that has broken through the level |

| 3 | Closing the deal | You can close part of the contract with a breakeven |

| 4 | Professional level | For all market players |

| 5 | Effectiveness | When the pattern is built correctly, it is very high |

| 6 | Using indicators | Not necessary |

There is also a double top, triangle, flag, pennant and many other patterns that can be very profitable to trade.

Option 4. Control and trend strategy

There is a small group of strategies by which trades are opened against the main trend. We do not recommend this direction of trading for beginners and do not use it ourselves either.

The bottom line is this: when the price of any financial instrument decreases, you need to open a buy deal, that is, counting on growth.

The trouble is that the market can move in the chosen direction for an infinitely long time, this will lead to colossal losses, the risk of losing money trading against the trend is simply enormous.

Option 5. Playing with the news

News trading is very profitable and simple at the same time, moreover, it does not require absolutely any knowledge. We have already discussed this technique in the article "Forex training from scratch", we will not repeat it.

Important news is not released every day, therefore, for stable and regular earnings on Forex, it is necessary to master other trading methods.

4.5 simple steps on how to play on the stock exchange - instructions for dummies

For successful trading on the exchange, you must follow the sequence of five simple steps outlined by us below.

Step 1. Choosing a broker

There are a lot of brokerage firms with which you can cooperate in the process of trading on the Internet - new companies appear almost daily. When choosing a broker, you need to pay attention to the training provided and trading conditions.

Finam is the most reliable company in the Russian Federation, it has already received our attention in previous articles. To trade in Finam, you will need at least 30,000 rubles of capital, but in return the trader receives first-class training and reliability.

If you are planning not to gamble on the stock exchange, but to make money, then Finam is the best option for starting your professional career.

The brokerage firm Freedom Finance conducts regular seminars and webinars on currency or stock trading. The broker is good because it provides adequate conditions for both newcomers to the market and professionals.

Experienced traders who have been trading on the exchange for five or ten years are always ready to support new clients. Recently, it became possible to trade by phone - you call or order a broker's call, give an order and continue going about your business.

West Capital is focused on stock trading. Specialists constantly analyze the market and provide clients with information about which securities are worth buying and which ones are better to refuse. You can buy shares with West Capital not only for speculation, but also for making money on dividends.

Information is obtained from the largest and most reputable sources, therefore, most traders have very high profitability, many reviews on the network prove this.

Opening Broker is a firm that attracts a huge number of clients by the opportunity to trade with experts. It's simple - after registration, you can choose a specific option for cooperation, for example, trading on the signals provided, and start opening deals.

Of course, you can trade on your own or outsource capital to experienced speculators through investment portfolios.

Some intermediary services offer new software, such as the popular broker Kalita Finance.

It does not hurt to take into account the period of work of the company in the financial market and reviews from real traders. We have already talked about this in the article "Trading on the exchange for beginners"

Step 2. Register on the broker's website

Usually registration is carried out in a few minutes: we indicate the name, e-mail and cell phone number. Subsequently, the manager of the selected company contacts us for advice.

Managers do not call clients at all brokerage firms, but mobile communication is the most convenient way to establish contacts.

You cannot trade immediately after registration - first you need to replenish your trading account or get a bonus for opening deals.

Step 3. Opening a personal account

Account requirements are always different, in some companies you can start trading even with a capital of a few cents. In most cases, to work, you have to replenish the deposit for at least $ 100.

Broker managers often persuade clients to immediately trade for real rubles or dollars, since intermediaries want to make money on spreads or commissions, but they need to stand their ground and not take risks.

Step 4. Download and install the trading terminal on your computer

A trading terminal is a platform through which transactions are opened in the financial market. It is downloaded on the website of the broker with whom we decide to cooperate.

Terminals installed from the websites of other brokerage firms will not work: you simply will not be able to log in.

Step 5. Start trading

When you have completed the basic training, mastered the terminal and thoroughly studied the trading strategy, you can deposit real money into the account and start serious trading.

The reason: if we inspire ourselves, then we allow emotions to control our mind, and "pessimism" creates the attitude "I have nothing to lose." It relieves the brain of the need to digest emotional outbursts.

Below we list five helpful trading tips. Take note of them so that trading constantly brings you profit!

At the opening of each new trade, we set a Stop Loss, upon reaching which the position will be automatically closed. The maximum loss should not exceed 2% of the capital.

If we lose 2% of the available money in a deal, we still have the right to 49 deals. With a working strategy in place, such an airbag will definitely lead to success.

In addition, if a large amount is lost, the trader ceases to be emotionally stable. In stress, amateurs often open deliberately losing positions and fly out of the market.

The strategy that the trader follows in the trading process should give clear instructions where to enter the market, and where it is better to exit.

Closing a trading position does not always bring profit, sometimes a loss is also obtained. However, traders who do not close orders on time, hoping for a market reversal, usually fly out of it.

It is possible not to concentrate on closing a position only when a breakeven is set - Stop Loss is set at the level of the opening price. But even so, there are dangers, such as gaps after the weekend.

Even if a trader does not open trades based on the news, he must view financial news and be aware of upcoming economic events.

This will avoid unnecessary Stop Loss due to price movements in an unforeseen direction, and will also reduce the number of false signals: on the eve of important events, the market is usually in a sideways trend, so it is better to ignore trend signals.

Sometimes it happens that a trader loses money in several transactions in a row. Newbies in such a situation will continue to trade, increasing their volumes and trying to "recoup", while professionals will stop and reflect.

The criterion for success is not a theoretical base, but a practical result - if in the process of trading there is a profit on the account, it is good, if there is a loss, you are moving in the wrong direction.

For training, a certain period in the market is randomly selected, the chart readings are redrawn, the trader makes a decision in accordance with his strategy - what to do.

6. Conclusion

We have reviewed several popular trading strategies in the financial market, have identified a number of important recommendations for successful trading.

It should be remembered that the result will appear only with daily work, you need to trade every day for at least one or two hours.

If you liked this article, please express your opinion in the comments and rate the material. Good luck and financial prosperity online!