Where to place stop loss

Hello guys, there is one more video. Probably a whole series of "tips for beginners" will have to be done. One of the most frequent questions that I come across is "where to put stop-losses". This question haunts anyone. On the one hand, with a large stop, you will lose more, but nevertheless, you are protected from volatility and you will not be knocked out. On the other hand, if you put a short stop, then in this case, you will be knocked out by volatility and, in fact, you will lose on a series of losses (and lose even more). So where do you place your stop loss?

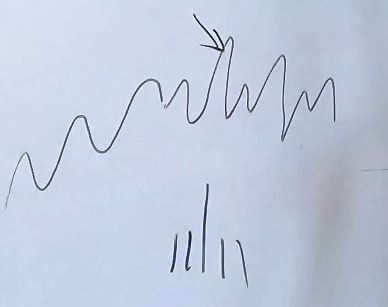

Remember once and for all: normal traders place a stop where the entry logic is lost. Roughly speaking, if, let's say, you trade extremes (movement of extremums, there is such a trading strategy) - you watch the extremes rise and your signal appears (say, "rails"):

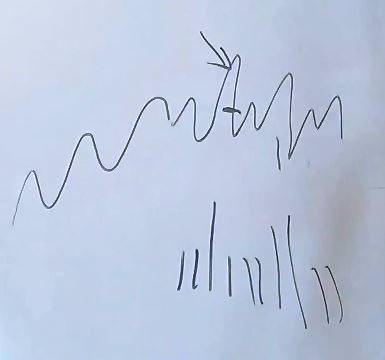

I hope there are no Gusev fans here, I really painted the "rails". There are "rails", where to place a stop, where is your entry logic lost? Your logic is lost here:

Or here:

This is where you place your stop. In this case, if here you are knocked out by a stop, it means that something has changed in the market and it will not go to the area you need. This will be a signal for you that you are mistaken, or the market has deceived you. Anything can be, right? Many are in favor of placing wide stops. I use wide stops when I trade some philosophy on large TFs. In this case, I place wide stops. Now it's very fashionable to talk about a major player, let me tell you about him too. For example, here a major player is gaining position, etc .:

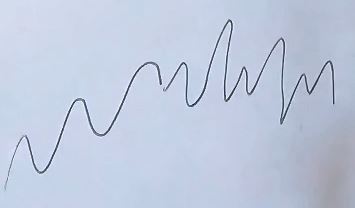

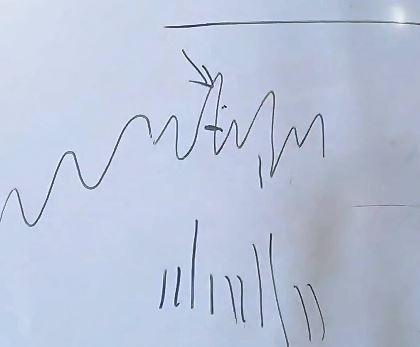

When a position is set by a major player in the long term, the movement is characterized by the fact that you will be constantly carried out in the footsteps. And in one direction and the other. This is done in order to gain more liquidity for a large player and, accordingly, load his position or unload (exit the position). Most often, loading is in progress.

In other words, imagine that you have come to a regular market and you need to buy, for example, 20 tons of potatoes. You cannot buy all these potatoes on the market, because, firstly, the price will be hampered, and secondly, there is no such abundance of these potatoes. What are you doing? The price, as Zhivas says, is advertising and it really is. You are spreading the rumor that potatoes will be very cheap tomorrow or, depending on the price movement, very expensive. What happens in this case? All buyers or sellers will try to exit the position, or, accordingly, enter the position. On the one hand, this is an exit from the position of a large player, on the other hand, an entry. It's about the same here. When the price moves in one area or another, a large level of liquidity is obtained. Those. the price left, it executed everyone in the footsteps (naturally, here the volume will increase from the executed stops):

In this case, when the stops are fulfilled, the price goes down, where everyone again makes some decisions, enters and here again knocks everyone out in the stops (again, loading or unloading, it does not matter) and again the following picture occurs:

This is because the big player needs to boot. Where to do it? This can be done by bringing people to their feet. Once, second time, third, etc. Or by arranging any large flats. In such paintings, you need to expose wide enough feet so that you are not bred and you do not come across:

But the profits here will be huge if you don't go wrong. Because if you are mistaken, of course, you are "kirdyk", because your feet are very wide.

Other people (like Gerchik, etc.) recommend using short stops. Guys, for the last few months I have been trying to enter with short stops on my experimental account, nothing good has come of it. I don’t know how in Western markets and forex, where it can and works. Where, for example, there are very beautiful entries on American stocks. It happens that there is a level at which the price beats clearly point by point and there is such a strong movement:

Here you can enter with a stop of just a few cents. This happens very often in American stocks, so if you have some money, go to the American stock market, really, I'm not kidding. But on the Russian market, at least on the derivatives market (I don’t know about stocks - I don’t trade), this is impossible to do, because there are always hairpins in one direction or the other. Those. you enter with a short stop and knocks you out, re-enter - knocks out again. In general, the drainage trade turns out. Because there is a series of losing trades with an increased volume (because you enter with the whole volume, not parts).

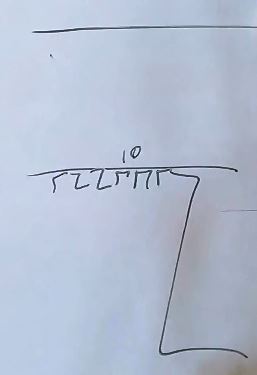

Further. There is such that traders do not enter immediately. For example, there are 10 lots with which you intend to enter a position and understand that the market does not allow you to do so at the moment. Those. there is no clear signal yet, but the trend is like you will come in. Or you have already entered, but the market began to cut. Therefore, very often traders enter in parts. Let's say we have some kind of movement, and a person entered once, entered two (averaged), averaged again, etc .:

Here, you act as appropriate, depending on your risk and reward in the area where you expect to receive it. And your hypothetical total stop should be 3 times less than your hypothetical profit:

In general, it is often said that the stop should be 3 times less than the profit. But it is not always possible to do this. Very often it is 2 times less. But if a trade involves a stop 1 times less or even less, it is better not to enter it. It is best to ignore this trade because you will not have a positive checkmate. expectations, you will drain. In fact, it all turns into some kind of binary options, where your estimated earnings amount will be less than the expected loss. You cannot do this, because you will gradually drain.

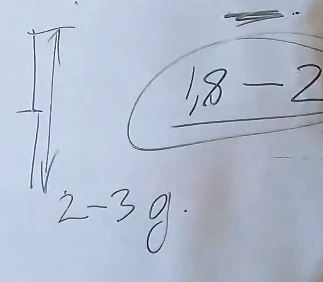

In one of the videos, I advised using the ATR indicator and I have actually used it before. But now I do not recommend using it - there are too many mistakes people make. You have to see for yourself, it will be much better than using ATR. Those. you can of course look at the ATR with a period of 1 (1.5 / 1.8-2 to be exact) and the average price move will be your stop. This is for the Russian market. Forex, like American stocks, may have a slightly different picture. In this case, you will not be constantly knocked out with some hairpins in the foot and everything will be more or less "like clockwork". But it is enough just to look at the size of the studs at the candles for the next 2-3 days and multiply by the same value as the period for the ATR (1.5 / 1.8-2):

This is when it’s impossible to place a stop at all, where the entry logic is lost, although for me personally this is surprising, because there is always a point where logic is lost. Again, you need to take everything into account. For example, if the expiration was recently or the expiration is approaching, then the feet should be wider accordingly. If some news came out, then the stops should also be wider. If we are talking about a dead evening session or an Asian session in Forex, then the stops should naturally be smaller, but in this case the profit will also be smaller.

Never be afraid to receive stops, no one is immune from this. If you do not catch stops, this is not an indicator that you are a successful trader or a trader at all. Why? Because I have come across such trading strategies where 30% of transactions bring huge profits. Moreover. According to more literate traders than me, they (to be more precise) have 10% of trades bringing 90% of the profit. All other trades are stops. If for profitable trading you need to use 90% of the stops, to hell with them. Let's get 90% of the stops in this case. If you need to get 20% of stops for profitable trading, let's get 20% of stops ... Don't be afraid of stops. Stops are completely normal and naturally there are no traders who do not receive stops. More precisely, there is, but these are the ones who are averaged. You can average, you can trade without stops. This is if you have a rubber account, a completely rubber account. In this case, you can trade without stops. How to do it? Let's say there is a section of the market where you average.