Finam: overview of trading conditions and financial instruments

Good day, dear readers of the blog site! The topic of today's article is the Finam brokerage company, which was among the first to appear on the Russian market and has gained immense popularity among traders.

The guarantee of the company's reliability is the license of the Central Bank. The Central Bank selects brokers very harshly, so don't worry, this company can be trusted. Below we will get acquainted with the available financial instruments of Finam, terminals for trading, conditions and promotions.

Brokerage services of Finam company

Have you read the very first article on the foreign exchange market -? If not, read it by all means, otherwise you will not delve into the key feature of Finam.

The broker in question does not specifically specialize in Forex, it offers a very wide range of instruments, including securities (stock market) and commodities / raw materials (oil, sugar, gasoline, etc. - the path of the commodity market).

At the very top of the main page of the official website of Finam, a control menu is available. First of all, here we should be interested in the items "Brokerage services" and "Forex".

In "Brokerage services" the administration offers to open a common account for trading with all existing financial instruments, in "Forex" - an account of a narrower direction, where only currency pairs are presented. They differ in minimum deposits and a number of other aspects, but more on that below.

The main difference is that there is no general account, for each transaction a commission is paid depending on its volume (read the article about). Let's first consider the first option, which will allow you to easily move from one market segment to another.

One account for professional traders

A single account gives us access to the following markets:

- The securities market of the Russian Federation.

- The market for forward contracts of the Russian Federation (futures, forwards, options, etc.)

- Foreign exchange market of the Russian Federation (just Forex).

- US stock market.

What commission does the broker charge when making transactions? It depends on the instrument and the number of positions: the larger the amounts we use, the lower the commission fees. The table below shows data for a daily trading turnover of less than 1,000,000 rubles; for US stock market shares, the value is given for a volume of less than 10,000 shares.

Dependence of the commission on the type of instrument.

The management closely follows technical innovations and offers customers the most modern software.

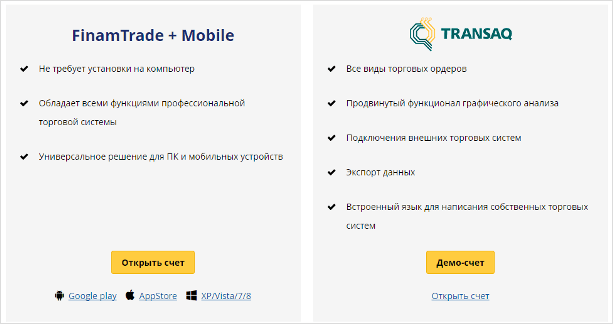

Three platforms are available for making trading operations:

- Finam Trade + Mobile - you can trade via the network without installing the program on your computer. Mobile versions have been developed for all existing operating systems.

- Transaq

The MetaTrader5 platform, which we briefly described in the article, is under development. In the near future it will appear in the list of available services.

Let's open a demo account for trading first through the Transaq platform (then we will carry out a similar operation to get acquainted with the Quik terminal) by clicking on the corresponding button.

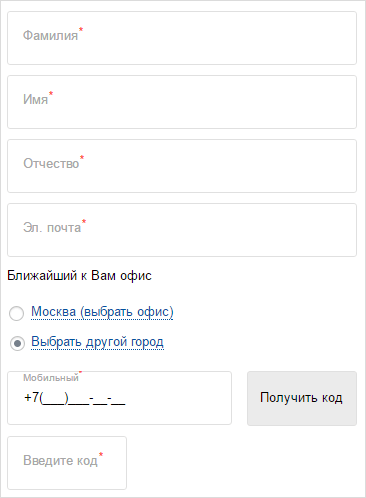

The demo account can be used for three months, no more. The registration form looks like this (passport data is not required for the training auction).

After entering the phone, a four-digit code will be sent to it. If you enter it correctly, the system will thank you for registering and send an email with all the information you need to get started (including your login and password, a link to download the terminal).

After installing the trading platform, you need to log in - enter the ID and password sent by the system to the mail. If the work is completed successfully, you can proceed to direct trading (and it is not necessary to enter your personal account, everything is done through the platform).

Transaq and Quik trading platforms

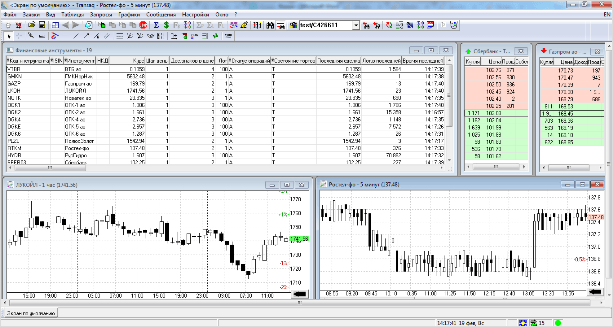

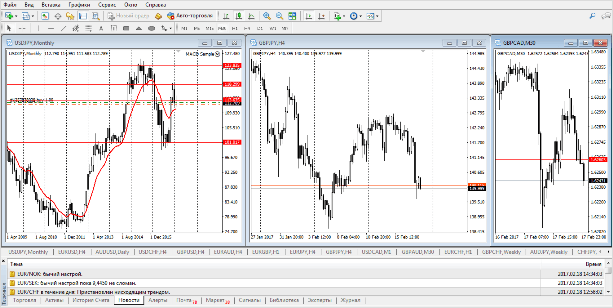

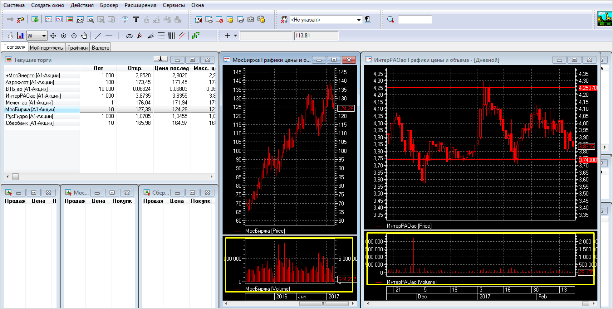

Transaq is completely different from MetaTrader, so you won't be able to open deals through it without preliminary preparation. Graphical tools, in theory, do not differ, but the interface is still different.

For example, compare the views of Transak and MetaTrader after the direct launch, obviously there are more differences than similarities.

MetaTrader.

To select a time interval, right-click on the chart, click "Periods" and specify the desired option. A total of 18 timeframes are available - twice as many as in MT4. Please note that intraday periods prevail, this is due to the fact that the stock market does not work around the clock, unlike Forex, and it is more promising to speculate “introday”.

![]()

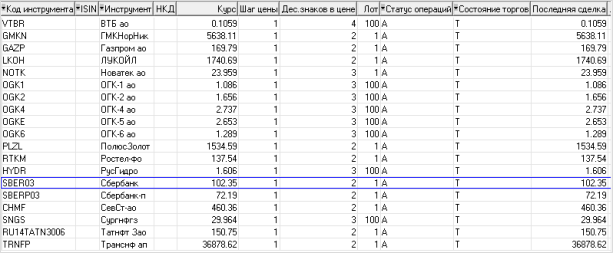

Securities (the “Master List” of Instruments ”) available for trading are listed below.

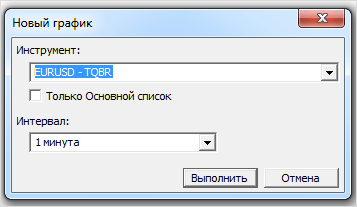

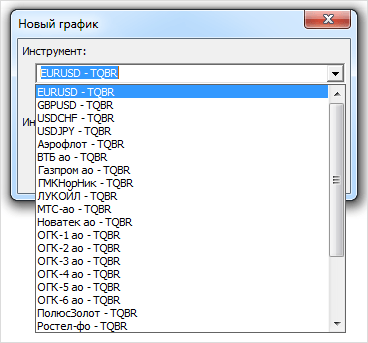

As you can see, you can trade the shares of the largest Russian companies. To view the full list of instruments, open the required charts, first select “Charts” - “New Chart”.

Then we indicate the desired financial instrument - the list is already more extended, there are currency pairs (although there are not as many of them as we would like).

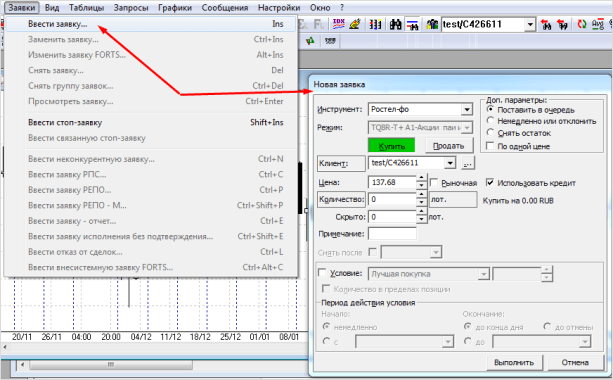

New positions here are not called orders, but orders, in order to create them, you need to go to the corresponding menu or press the Insert button on the keyboard.

Significantly more new parameters, right? Do not oversimplify, however, as amateurs: "Forex is simpler than the stock market, and options are simpler than Forex" - everywhere there are peculiarities, pros and cons.

The Quik terminal seemed to me somehow more accessible: the interface is intuitive. By the way, many users who switched from the foreign exchange market to the stock market (as testimonies testify) are in solidarity with me here. The work area looks like this (of course, you are allowed to open other windows).

In the screenshot above, I marked the “bars” under the price charts with yellow rectangles. This is done so that you pay attention to the volume indicators, which we will talk about in the articles on "Indicator Analysis on Forex".

On the stock exchange, the volumes are not tick, but monetary, they show the real amount of money invested by clients, therefore, they are considered quite authoritative indicators.

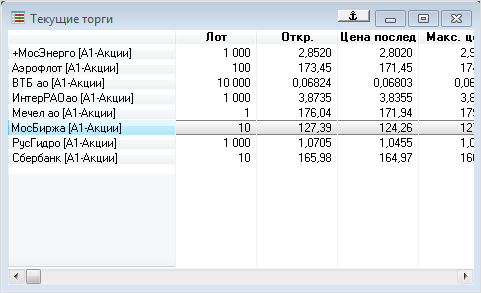

Take a look at the lots traders are trading.

Not comparable to some 0.01 - 0.02 that we operated on, right? I would like to emphasize once again that the stock market operates according to completely different laws. If you learn to see not only the key theoretical differences between certain segments, but also to feel their deep features, you will move a big step forward in trading (after all, the financial market, in theory, is the only one, these are people, for convenience, divide it into its component parts) ...

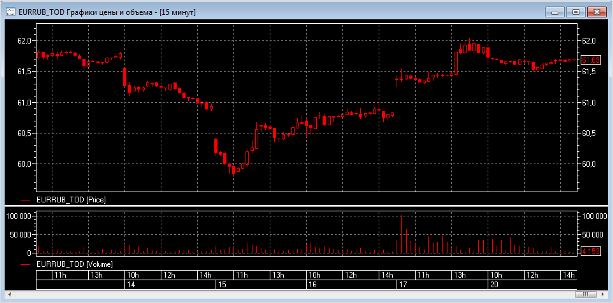

When trading through Quik on a single account, we are faced with currency pairs that have not previously appeared in any review published by us, because the standard currency accounts of brokers, for the most part, do not allow trading them. An example is the EUR / RUB chart (Euro / Russian ruble).

To open a real account, in addition to the information provided, you will need scans of passports, TIN. Any “normal” broker pays 13 percent tax on client profits at the end of the year or when applying for a withdrawal of earned funds. If the trade turns out to be unprofitable, you will not have to pay any taxes.

To open a real account, capital is required in the amount of 30,000 rubles. Please note that this applies only to a single account type. Everything is much easier with Forex.

Account for currency trading in the Finam company

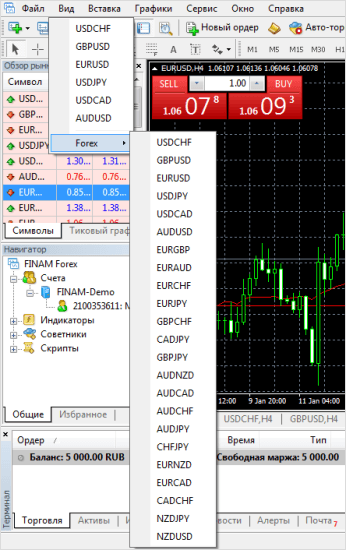

So, let's return to the path closer to us. Go to the Forex heading and find that trading operations are performed through the already familiar MetaTrader, you can work with 26 currency pairs - enough for both beginners and professionals.

Here we similarly need to create a demo account and download MetaTrader. The amount of funds on the demo account is $ 5,000.

A list of all currency pairs that can be traded is presented in the screenshot below.

At first I thought that there are much more of them than in Alpari, but the euphoria quickly passed: minor instruments are not separated from major ones, and this is a deceptive appearance. So Alpari is absolutely not inferior to Finam in terms of the number of assets.

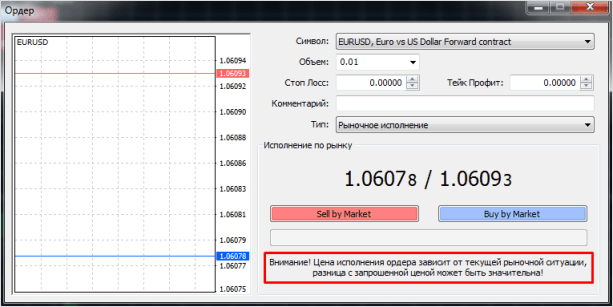

The procedure for opening a new order is distinguished by the impossibility of setting an indent. That is, the deal will be opened at the price that will be in the market when you click the "Sell" or "Buy" button. The system eloquently warns that the deviation may be significant, but does not try to protect against it.

Here, the minimum threshold is only one hundred dollars, so you can start successful trading without much stress, create a real account, enter money and start earning.

Shares for Finam traders

Finam offers its clients various promotions to get a higher income (all information is presented in the personal account for registered traders, for unregistered ones - just on the website). I personally am not a supporter of any "bonuses" or "gifts", since free cheese is always only in a mousetrap. However, as part of the review, I consider it necessary to talk about them.

You can receive a Broker + card through a bank branch and transfer money from it to your trading account. A credit is provided on the card, the maximum amount of which is 6,000,000 rubles. This money is needed to be injected into the auction. Loan term - 11 months and 20 days.

On the one hand, it's good, there are more opportunities, on the other hand, it seems to me, you should never trade with borrowed funds. Never. This is a market, he likes to surprise at times.

On borrowed funds, of course, interest is charged - exactly 15 per year. This is not so little, if you operate with large amounts.

If you make financial transactions on a single account, you can insure the purchased shares against a decrease in their value. This is not done for free, but if the stocks suddenly really fall sharply (and they are capable of such things, which cannot be said about most currency pairs), Finam will pay you most of the lost money.

The cost of insurance is 4 - 9 percent of the price of the entire block of shares. If, for example, we have 100,000 Lukoil shares and their market price is 3,000 rubles, we can insure the package for three months (the terms vary in the same way) by paying Finam 6 percent of the total value of all shares. The amount of insurance will be 3,000 * 100,000 * 0.06 = 18,000,000 rubles (I exaggerate, of course, although there are large players working with such amounts).

If suddenly the price drops by 400 rubles, the possible losses will amount to 40,000,000 rubles, if we have insurance, we will lose half as much.

Intraday traders do not need insurance as they open and close within one day and do not have to worry about gaps. Proponents of long-term and medium-term trades use insurance regularly.

How do you plan to dispose of the money that you earn on the exchange (if you earn it)? Put it in the bank? Excellent, Finam also provides such an opportunity, the amount of interest per year depends on the time the funds are in the bank. For an account of the “Maximum” type (the minimum deposit amount in rubles is 10,000), the conditions are as follows.

| Term (days) | 31 — 60 | 61 — 90 | 91 — 180 | 181 — 364 | 365 — 731 |

| Bid (%) | 5 | 5,75 | 7,5 | 8,5 | 8,5 |

If you deposit money into an account of the "Best" type (the minimum amount in rubles is 300,000, in dollars or euros - 3,000), the conditions are slightly more promising.

Naturally, it is necessary to motivate people to invest in rubles, since the dollar in the long term maintains an upward trend, the rubles can be multiplied much more efficiently than the American currency.

Trading training with a broker Finam

We examined the main promotions and opportunities for increasing capital (the rest periodically appear and disappear, so you need to track the situation directly through your personal account), now let's talk about training.

I was immediately struck by the prospect of observing the real transactions of professional traders through the "Trading Hall". At certain times of the day, you can connect to online broadcasts, watch the trade of professional introday speculators and scalpers. It is allowed to ask questions to the presenters or other "observers", to discuss the reasons for opening / closing deals.

Naturally, the "Trading Room" cannot be perceived as a step-by-step guide to action: all transactions will definitely not be profitable, but you can improve your trading skill by watching the broadcasts very well.

Paid lessons prevail among training webinars and seminars. There are, of course, completely free basic lessons for beginners, where they become familiar with the trading platform, the essence of Forex, and the basics of those. analysis, but you have to pay for more serious things.

When we are, we will notice that things are much better there: a huge number of free webinars, and there are no paid ones as such: access to viewing some courses can be obtained after replenishing a trading account for a certain amount, money is subsequently withdrawn without problems, the maximum loss - commissions charged by payment systems.

From time to time, Finam hosts free video seminars on various aspects of trading. They will be of interest to those who are already relatively confident in the market, have successfully mastered the basic course and are able to "highlight", form their own trading strategy. Examples of seminar topics.

In my opinion, an interesting section is the "Trader's Library", where a lot of useful information is presented in text format. Unfortunately, the material is not yet available in all sections, on Forex in general it is rather poor, but a lot of interesting things are available on the stock market.

Conclusion

So, dear friends, we have completed a brief introduction to the main features of the Finam broker, talked about trading platforms, financial instruments, educational programs.

The broker has been successfully operating since 1994, it has stood the test of time with dignity, and the reviews on its network are quite passable. There is no need to worry that the company will somehow steal your money or paint on the “wrong” quotes on the charts.

You can register directly with Finam and start exploring the market, you can read articles about other brokers (see the 11 best companies in the article), in particular, material from a pro - firm that gives huge deposits to successful traders on favorable terms (this is a rare example of not cheese in mousetrap).

If you have any questions, feel free to ask them in the comments. Thank you, good luck with your trade, maximum profitable trades.