Brokers with the cheapest rates for buying stocks

Invest hello friends! Everyone who decides to invest in stocks, bonds and other Gazprom thinks: which broker is better? Where can I open an account so as not to go bankrupt? After all, it is important to choose not only a reliable broker with convenient account management, but also with minimal costs. After all, the less you spend on commissions and custody services, the more profitable your investment will be.

So, you are thinking about which broker to choose. I recommend checking a future partner (yes, a broker is your closest partner in buying shares!) According to several criteria.

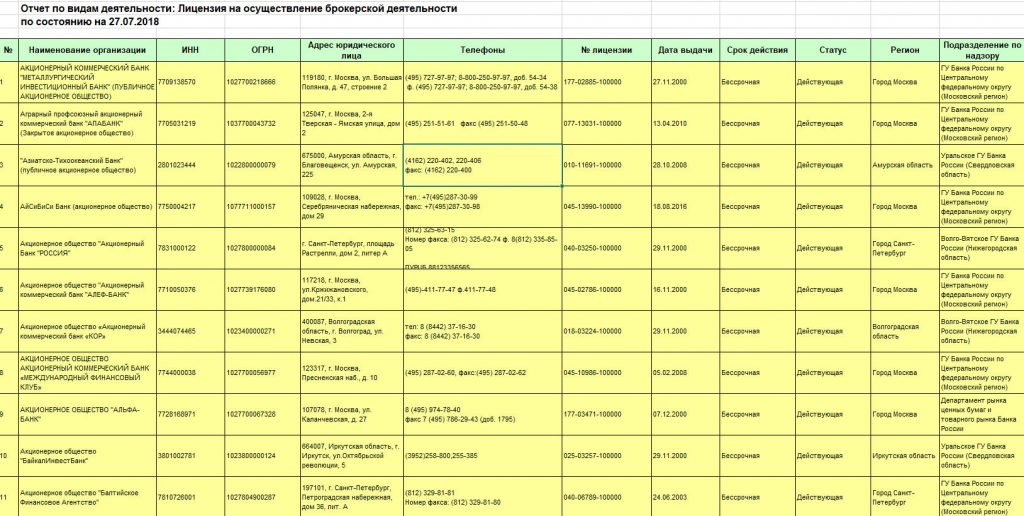

- Reliability. Well, everything is clear. The broker must have a license. Moreover, the Central Bank, and not that strange office from the Cayman Islands. After all, he is the registrar of your shares. A licensed broker will actually make all the records and keep a bunch of documentation, and an offshore one will simply draw candy wrappers. A list of which brokers are reliable and licensed can be found here: http://www.cbr.ru/finmarket/supervision/sv_secur. Scroll down to the bottom. Important: there is no rating for the reliability of brokers. There is an alphabetical order of those who generally have a permit to work in the stock market.

- Convenience. The broker's website should not have a jerky-eyed interface and incomprehensible trading programs that slow down more than the giraffe in the famous joke. After all, you are staring at this "beauty" regularly. The site interface should be clear and concise so that you can quickly find the information you need. The same goes for documentation. It must be visible.

- Large selection of tools. Of course, if you want to buy securities only of Sberbank and Gazprom, then the London Stock Exchange has given up to you. But if you want to become a Google shareholder or Yabloko, then it is important which broker to work with. You definitely need a broker with international connections and licenses that allow you to trade on the New York, London, Frankfurt and St. Petersburg stock exchanges. This is, so to speak, a gentleman's set.

- Low rates and no hidden fees. We'll talk more about this below.

- IIS opening. If you want to get your paid taxes back, then an individual investment account is a must have. How to open it and what is the point of the IIS -.

- There are many ways to apply. You probably won't have to use phone bids (remember how in the movie Americans everyone yells into the phone, “Sell! Buy!”). But if there is such an opportunity, great. You may hear on the radio that Yandex stocks are starting to skyrocket and want to sell them. And you are driving. One call to the broker and the problem is solved.

- Modern trading platforms. The presence of QUIK or MetaTrader is a sign of good form. Of course, a broker can offer their own trading platform or a web interface in general. But check that everything works well.

- Is there any analytics. This will help you make informed decisions and find unexpected options for enrichment. You can, of course, apply a life hack. Keep money with one broker, and use the analytics of another by replenishing your account with a "minimum wage". Nobody can prohibit anything here.

I cannot give a definite answer which broker is the best. Analyze the broker according to the proposed criteria, and you will be able to choose the most suitable one for you.

And, of course, study the reviews - what are the best brokers, only the experience of those who used the services of these comrades will tell you. A cool source of all trash and waste in relation to brokers is the banki.ru forum. There you will learn everything about hidden fees, slippage, non-submission of documents and loss of money by the naval method from the first hand.

Broker commissions

In general, brokers are approximately equal in terms of the quality of their services (if we are talking about the largest players). And the tools are offered in an equal number.

The most important difference is what the broker's commission is. The choice often depends on this. For example, if you have a lot of capital, then the return on it will be good, and you can not pay attention to the commission at all. For example, if you have a million (here is an article, by the way, where to invest this million).

Now about what interest the broker takes:

- commission per transaction - the broker charges a fee for the sale and purchase of assets, which, as a rule, is literally tenths or even thousandths of a percent;

- exchange commission - it depends on which exchange you stock up on stocks and bonds, but, as a rule, it is also small;

- service fee - charged by some brokers on a monthly basis, as a rule, it is reduced by the amount of commissions already paid for the transaction;

- payment for using the terminal - a very rare type, as a rule, they are charged for connecting to mobile trading and only once;

- the commission for using the depository is usually 150-300 rubles per year, this is the fee for making entries in the register.

In addition, there are additional fees. For example, if you trade short on REPO. Or give the order by phone. But, as a rule, novice investors rarely use such services.

Please note that these commissions are relevant for the stock market, i.e. to buy stocks, bonds and ETFs. There is a separate fee for work on the foreign exchange, OTC and derivatives sections. So, for the purchase of a forward contract, Sberbank Asset Management takes 50 rubles.

Brokers with minimal commissions

Now more specifically - which broker to choose for trading. I have selected the most reliable and super-duper advertised brokers - in general, this is a certain rating of brokers on the Moscow Exchange. In the table, you will see the name of the broker, commission, minimum capital and a small comment.

Yes, commissions are relevant if the daily turnover is not more than 100 thousand rubles.

| Broker | Rate | Commission per trade | Account management fee | Depository fee | Min. sum | A comment |

| BCS | Direct | 0.3%, but not less than 99 rubles | RUB 200 (in the form of a commission for MetaTrader 5) | 177 rubles per month | No | Perfect for investors planning long-term investments |

| Start | 0,0354% | 354 rubles | 177 rubles per month | No | The total commission for maintaining an account is reduced by the amount of paid commissions, the tariff is suitable for active traders | |

| Finam | Single account | 0,00944% | 177 rubles | 177 rubles per month | 2000 rubles | The broker offers many trading platforms and a wide selection of assets |

| Alpha-Direct | Optimal | 0,04% | No | 0.004% of the total assets per year | No | Special conditions for clients of Alfa-Bank |

| VTB | Single | 0,065% | No | 100 rubles per month | 100,000 rubles | Conditions are good, but a large minimum wage "bites" |

| Uralsib Capital | Basic | 0,0472% | No | Any | No | An excellent platform for novice investors |

| Zerich | Great start | 0,1% | No | Any | No | Bonus broker offers 4 investment ideas every week |

| Alor | Welcome! | 0,017% | 250 rubles | 100 rubles per month | 10,000 rubles | Account management fee is reduced by the amount of paid fees |

| Opening | Universal | 0.057%, but not less than 4 kopecks | 295 rubles | 0.01% per month, but not less than 100 rubles | Any | The commission for servicing the account is canceled if the account has more than 50,000 rubles |

| Sberbank | Independent | 0,06% | No | 250 rubles per month | No | Reliable broker from the largest bank in the country |

| ATON | Starting | 0,18% | No | No | 50,000 rubles | Not very attractive tariff and high entry threshold |

| Promsvyaz-bank | Day | 0,05% | No | No | No | One of the options for beginners |

| Solid | First | 0,11% | No | 200 rubles per month | 10,000 rubles | Good option for the pros |

| Tinkoff | Tinkoff Investments | 0,3% | 99 rubles | No | No | Great option for long-term investors and newbies |

So who should you choose?

So which stock broker to choose in the end? It all depends on your needs:

- if you plan to execute transactions constantly, then you need brokers with a minimum commission per turnover - BCS, Finam, Alfa-Bank;

- if you have a small capital and you plan to increase it every month - you need a broker with no service fees and a depository, for example, Uralsib, Promsvyazbank, Tinkoff;

- if access to all instruments from one account is important for you and you do not want to pay separately for each service - pay attention to BCS, Otkritie, Finam, Alfa-Direct, Tinkoff;

- if you have a lot of capital and it is important to save on large volumes - Finam, Otkritie and Tinkoff are suitable.

If the question arises of which broker to choose for a beginner, then there are 5 possible options:

- Promsvyazbank - minimum commission per transaction, no other types of fees, many instruments;

- Zerich - the same, plus you get free investment ideas;

- Alfa-Direct - also minimal commissions;

- Uralsib Capital - similarly;

- Tinkoff - the commission may be large, but you don't need to install anything, and you can buy shares directly in your browser or mobile application (here on the service, and here).

Conclusion

Thus, no one but you will tell you which broker is better. Make your choice and don't worry. A broker is not forever. If you don't like it, you can always change it - your assets are recorded in the depository and belong only to you. No investor has ever had a problem transferring assets to another broker. So that's it. Think for yourself, decide for yourself. And may the money be with you!